we provide unconflicted advice to

successfully execute your financial

and fundraising strategy.

Our DNA

360° expertise

We believe a holistic approach to equity advisory is best suited to deliver accurate, reliable and independent advice.

Our team

Operating Team

Vincent Rietzler

Co-founder & Managing Partner

25 years’ experience in Investment Banking

Vincent has over 25 years of experience in Investment Banking including nearly half of which at Lazard. After founding his first equity advisory firm, he joined ODDO BHF as Head of Equity Capital Markets and moved to Natixis as part of the partnership between the two groups. Vincent graduated from University Paris-Dauphine (Master Degree in International Financial Markets).

Edouard Narboux

Co-founder & Managing Director

18 years’ experience in Investment Banking

Graduated from the Business School & University of Montpellier, Edouard has spent 7 years in investment banking at ODDO BHF Corporate Finance before moving to Switzerland to co-found Kepler Corporate Finance in 2009. Since September 2015, Edouard, as a co-founder, is involved in the development of Aether Financial Services, Agency Services leader in France.

Baptiste Pourtout

Partner

15 years’ experience in Corporate Finance

CFO experience in Life Sciences companies

Baptiste has spent 15 years in multiple finance positions whether for large international or small companies. He first joined a subsidiary of Total USA and subsequently Novartis France as a financial planning analyst in the corporate finance department. From 2011, he served as finance manager then Chief Financial Officer for two French listed biotech companies. He was involved in numerous fundraising operations from IPO to private placement. Baptiste graduated from NEOMA Business School and holds an international certificate in corporate finance from HEC Paris.

Transaction Support

Henri-Pierre Jeancard

Co-founder & Managing Partner

20 years’ experience in Project Finance and ECM

A graduate from Ecole Nationale des Travaux Publics de l’Etat, Ecole Nationale de la Statistique et de l’Administration Economique and the Sloan School of Management at MIT, Henri-Pierre has an investment banking background from a 20-years career at CA-CIB, ODDO BHF and Bryan, Garnier & Co. Since September 2015, Henri-Pierre, as a co-founder, is involved in the development of Aether

Financial Services, the French leader in Agency Services.

Lionel Labourdette

SENIOR ADVISOR, PhD, MBA

Financial Analyst and Fund Manager >20-years experience in Life-Sciences

After 8 years of academic research (CNRS, CEA), Lionel joined the financial markets as a Pharma/Biotech analyst at Dexia Securities and then HSBC Securities. In 2004 he became CFO of a French biotech (Laboratoires Goemar) for 5 years. After preparing for a sale to Private Equity funds, he returned to the financial markets where he brought his expertise to Dexia Securities and later to Kepler Cheuvreux and actively participated in several IPOs of biotechnology / medtech companies on Euronext. Lionel joined the asset management in 2015 where he co-managed Kalliste Biotech Fund.

Lionel holds a PhD of Biochemistry and an MBA of EM-Lyon and graduated from Ecole Normale Supérieure de Lyon.

Ghislain DE MURARD

Senior Advisor

35 years’ experience in Corporate Finance

presentation de Ghislain DE MURARD

WHAT WE DO

Advise and assist our client in their financial and fundraising strategy for the long term.

SCOPE

We advise and support our clients

in implementing their financial and

fundraising strategies across every

phase of their growth.

Key insights for each step forward.

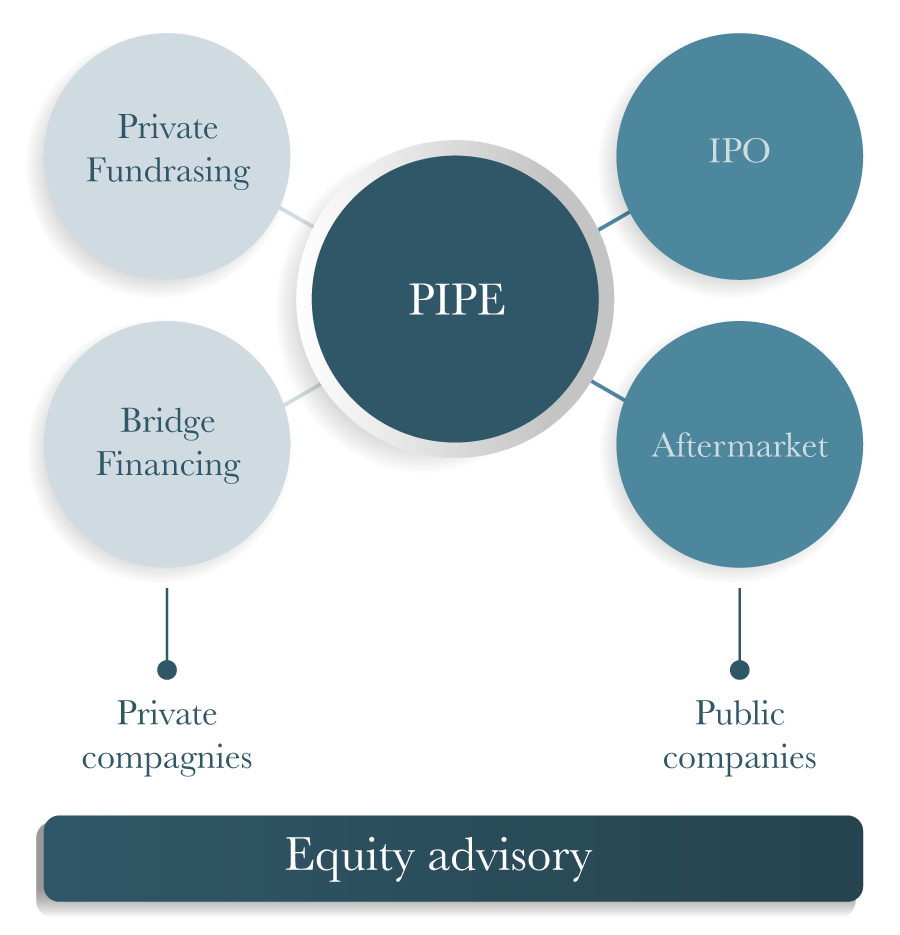

Financial Advisory

Advise to define your financial strategy and act as your «sparring partner» for all issues regarding capital structure optimization and financing opportunities

Equity Capital Market Advisory

- Validate assumptions and objectives of the Investment Case and Business Plan

- Draft of the Equity Story

- Define the transaction structure and potential alternative options

- Advise on the proposed financial terms

Fundraising

- Pre-IPO Advisory

- IPO Advisory

- Aftermarket

Listing Sponsor

Accredited to act as listing sponsor by Euronext, we assist and guide issuers with their first admission to trading and ensure (on an ongoing basis) that issuers comply with the legal and regulatory requirements in terms of transparency and financial communication resulting from the first admission to trading.

Sign of confidence for investors, the appointment of a listing sponsor is mandatory for any company aiming to be listed on Euronext Growth, Euronext Access and Euronext Access+.

Our client focus

Stakeholders

Company profile

WHY ALCé

A comprehensive approach to Equity Advisory

Financial

Advisory

and confidentiality

- Expert knowledge of the analysis grid of financial transactions

- Holistic approach to capital raising

- Provide and share in-depth and unbiased analysis

Build your success on key financial milestones

Independent

Sounding Board

Accuracy

- Advise on key decisions related to financial and shareholding issues

- In-depth experience to navigate market practices and ecosystem

- Unconflicted advices on proposed the financial terms

Sharpen your

decision-making

EXECUTION

Agility and commitment

- Adapt our involvement at every stage of the project to sucessfully achieve your objectives

- Steer the process on your side

- Ensure that potential issues are raised and solved in due time

Anticipate and focus on key steps

Strengths